Dear Mr Modi,

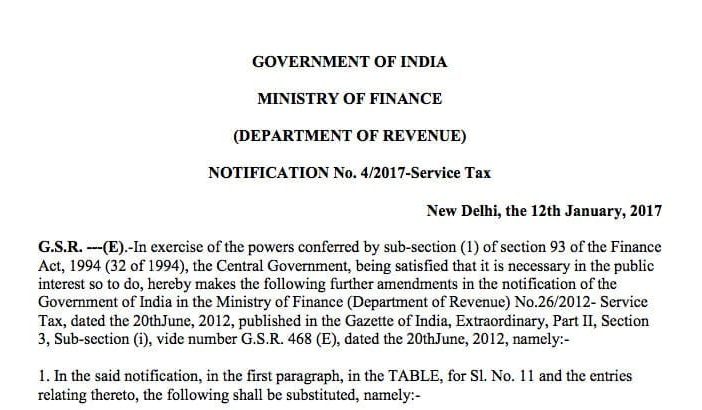

My right to livelihood is under threat.I am an outbound tour operator based in India, and on 12th January 2017, the Ministry of Finance (Deptt. of Revenue), Government of India, released a notification no. 4/1/2017, pertaining to an increase in service tax. This increase in service tax, coming into effect on 22nd January 2017, will make my business unviable. Let me explain how:

- I am offering outbound tour services to Indian citizens, such as hotel accommodations, transport, and activities.

- The exact same services are offered by my international competitors.

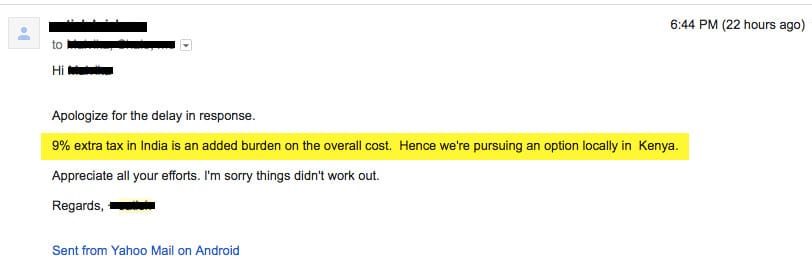

- I have to pay service tax, making my outbound tour services 9% more expensive than my international competitors.

- Indian citizens who could have potentially been my customers are opting to travel with my international competitors rather than with me (because of this added burden of service tax).

- This is not a level playing field, and I am losing business.

On another note, all the services I am offering are already being taxed in the country of their origin, making this a double taxation for the Indian citizen. For example, Tanzania charges a VAT of 18% on all the services I am offering. With the added Indian government taxes, an Indian citizen has to pay 27% taxes in total.

This increase in service tax will cause a severe loss of jobs across the industry. In the long-term, the outbound tourism industry in India will be crippled, causing huge losses.

My right to livelihood is an implied fundamental right under Article 21 of the Indian constitution. This amendment by the Ministry of Finance is threat to my livelihood, and I request you to kindly repeal it immediately.

Yours sincerely,

Tanvi Srivastava

Director – Chalo Africa Tours Pvt. Ltd.

Share these tweets and leave your comment below!

@PMOIndia – An Open Letter to PM @narendramodi from an Indian Outbound Tour Operator. https://t.co/jiA7xfrCQp

— Tanvi Srivastava (@tanvisrivastava) January 18, 2017

@arunjaitley Notification no. 4/1/2017 by @FinMinIndia is threat to my livelihood. Kindly repeal. https://t.co/jiA7xfrCQp

— Tanvi Srivastava (@tanvisrivastava) January 18, 2017

Sunanda says

Dear Mr. Prime Minister,

You are already taxing us on our incomes here in India for the work we do. And you are already taxing the company for the work it does in India.

I simply can’t understand why you have to tax products and services that are being provided overseas, by entities who have nothing to do with India, and for products and services that are already being taxed in their home countries!

How can any business be competitive in the global evonomy with these crippling taxes and even crazier documentation requirements?

Perhaps this explains why good, honest companies are forced to shut shop, and why dishonest companies thrive, racking up large amounts of illegal transactions that you were supposedly trying to bring to an end with your demonetization scheme!